flow-through entity tax form

Information about Form W-8 IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. AR362 PET Election or Revocation.

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

Schedule A Pass-through entity tax PTET paid on your behalf see instructions Submit this form with Form IT-201 IT-203 or IT-205.

. As enacted this tax is retroactive to tax years beginning on or after January 1 2021 for flow-through entities that make a valid election. Form 5773 Non-electing Flow-Through Entity Income Template Form 5774 Part 1 Corporations Insurance Companies and Financial Institutions Template Form 5774 Part 2 Individuals. October 2021 Department of the Treasury Internal Revenue Service.

Flow-Through Entity FTE Tax Return Form 5772. E-FIle Directly to your State for only 1499. Apportionment Calculation and Business Income Identification.

They will receive a credit for their portion of the. Eligible credit claimants must file an individual personal income tax return and attach Form IT-653 Pass-Through Entity Tax Credit to claim the PTET credit. Its gains and losses are allocated or flow through to those.

Individuals will be required to report their share of Michigan income received from a flow-through entity on their Michigan 1040. Pass Through entities must provide to its entity owners a Schedule RK-1 and NRK-1 detailing the entity owners share of pass through income and losses. The information in this section also applies if for the 1994 tax year you filed Form T664 Election to Report a Capital Gain on Property Owned at the End of February 22 1994 for.

The flow-through entity tax annual return is required to be filed by the last day of the third month after the end of the taxpayers tax year. Branches for United States Tax Withholding and. Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US.

The PTET credit may not be. E-File Free Directly to the IRS. An individual that elects not to participate in a composite.

For calendar filers that date is March 31. AR1100ES PET Pass-Through Entity Estimated Tax Vouchers. A Form CRFS filed with the pass-through entity in lieu of the Form PTE-EX must be filed according to the Form PTE-EX filing dates.

Names as shown on return Identifying number as. Ad Premium State Tax Software. If you filed Form T664 Election to report a Capital Gain on Property owned at the End of February 22 1994 for any of the above shares of or interest in a flow-through entity.

All Extras are IncludedNo Fees Necessary. Income From Pass Through Entities. All payments under the flow-through.

AR1155 Pass-Through Entity Extension Request. Michigan Treasury Online MTO Screenshots. A flow-through is a business entity that may generate or receive taxable income but which pays no income tax in its own right.

:max_bytes(150000):strip_icc()/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

Form 4797 Sales Of Business Property Definition

Instructions For Form 8995 2021 Internal Revenue Service

Elective Pass Through Entity Tax Wolters Kluwer

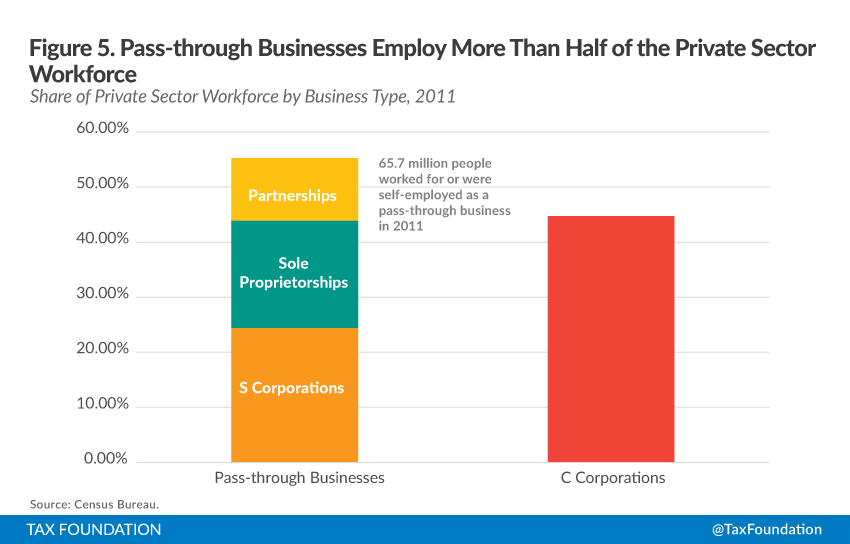

An Overview Of Pass Through Businesses In The United States Tax Foundation

Complying With New Schedules K 2 And K 3

/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

Considerations For Filing Composite Tax Returns

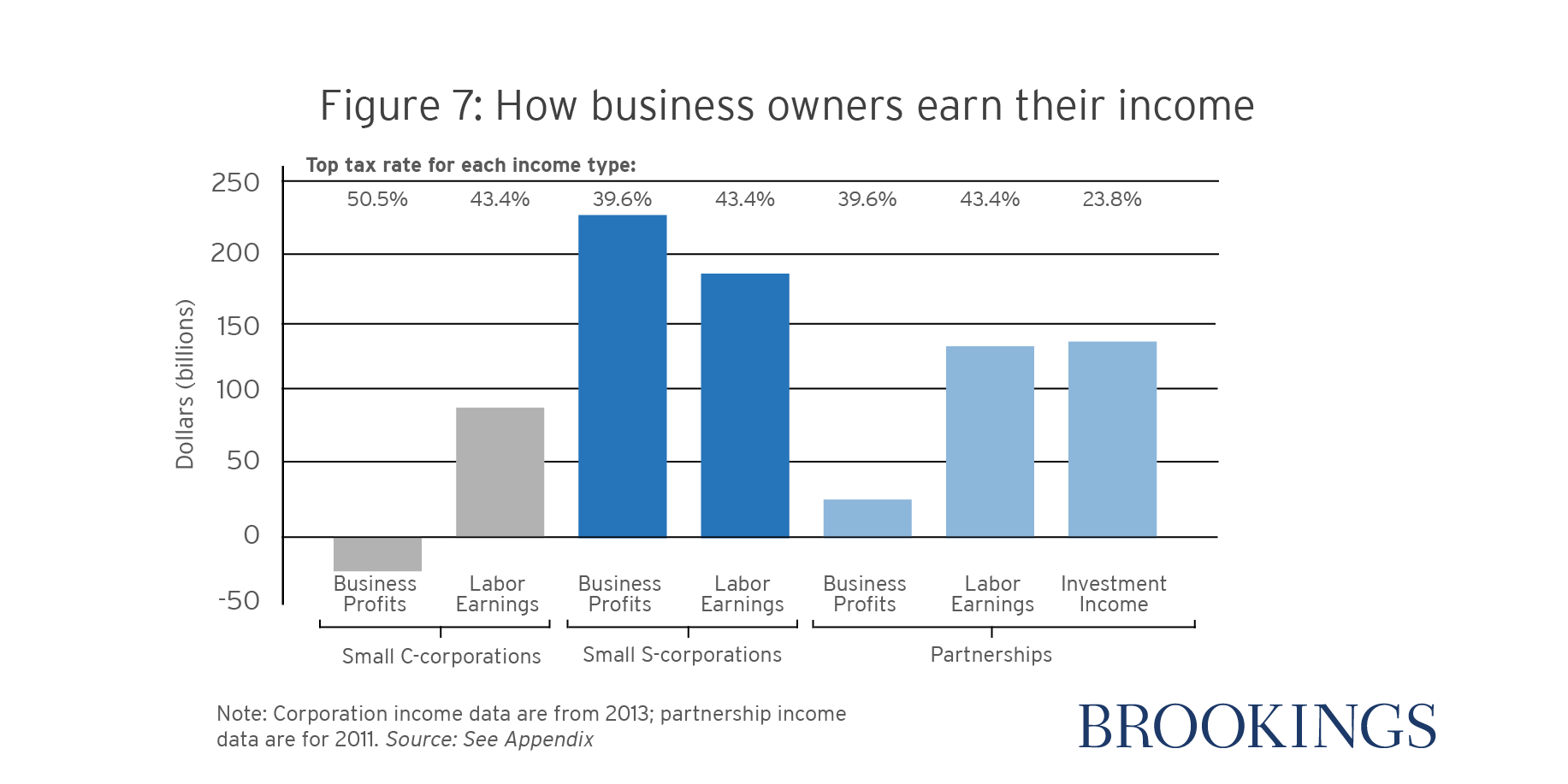

9 Facts About Pass Through Businesses

Pass Through Entity Definition Examples Advantages Disadvantages

Understanding The 1065 Form Scalefactor

Pass Through Taxation What Small Business Owners Need To Know

An Overview Of Pass Through Businesses In The United States Tax Foundation